iPhone sales are plunging. Here's why.

Nikki Haley lands new gig after dropping out of GOP primary

'Miracle' weight loss drugs have made health disparities worse, doctors say

What we know about Channing Tatum and Jenna Dewan's financial legal battle

'Go home': Over-tourism sparks angry backlash in Spain

Stories for you

- WorldUSA TODAY

California valedictorian will no longer give graduation speech over 'alarming' discussion

The University of Southern California says Asna Tabassum will no longer speak at the ceremony after the discussion about her selection took on "an alarming tenor."

4K3 min read - SportsYahoo Sports

WNBA Draft winners and losers: As you may have guessed, the Fever did pretty well. The Liberty? Perhaps not

Here are five franchises who stood out, for better or for worse.

7134 min read - SportsUSA TODAY Sports

Caitlin Clark is best thing to happen to WNBA. Why are some players so frosty toward her?

Caitlin Clark playing in the WNBA could lift women's sports to incredible heights, which makes any resentment toward her just baffling.

1.9K8 min read - SportsCNN

Chinese runner’s win invites suspicion after rivals appear to step aside

Chinese runner He Jie’s victory in Sunday in the Beijing Half Marathon is facing a probe after his win was called into question by Chinese internet users because a trio of African runners appeared to deliberately slow down to let him win.

8713 min read - USWashington Post

Fire chief adopts puppy from fire scene: ‘I was so sad he’d been burned’

Two days after a fire burned a rental home to the ground in Brookings, Ore., Aubrie Krause was at the scene conducting an investigation. She heard a small whimper coming from beneath a trailer near the charred remnants of the home.Subscribe to The Post Most newsletter for the most important and interesting stories from The Washington Post. Krause, a deputy fire marshal for the state of Oregon, crouched down to get a closer look and saw a frightened puppy hiding. She knew that no people were inju

994 min read - CelebrityBuzzFeed News

Katy Perry Was Forced To Hold A Cushion Over Her Chest And Hide Under The “American Idol” Judges' Desks After Suffering A Seriously Awkward Wardrobe Malfunction Live On Air

“You know it's serious fashion when the power tools come out.”View Entire Post ›

152 min read - LifestyleBuzzFeed

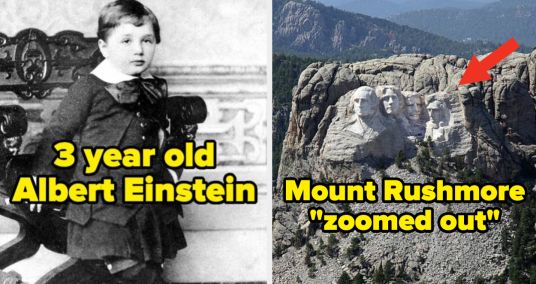

I'm Pretty Much The Dumbest Guy On Earth So These 21 Absolutely Incredible Pictures Absolutely Put My Brain In A Blender Immediately After I Saw Them

I am flabbergasted.

933 min read - LifestylePetHelpful

Man Gets Sweet Surprise When Neighborhood Squirrel Brings Her Baby to Meet Him

The mama squirrel really trusts him!

03 min read - ScienceThe Weather Network

La Niña will make a comeback this summer as El Niño finally fades

The revised forecasts issued by scientists have been revealed, and the verdict is clear: La Niña will make a comeback

311 min read - LifestyleNY Post

I’m an ex-Mormon — here’s why members of my former church look alike

Alyssa Grenfell pointed out that Ryan Gosling, 43, was born Mormon, noting in her video caption that "he has Mormon face."

9883 min read - LifestyleINSIDER

I worked at Disney World for over 3 years. Here are answers to 8 questions guests are too embarrassed to ask.

As a former Disney World cast member who spent three years working in the parks, I've answered plenty of "embarrassing" questions from tourists.

1096 min read - LifestyleYahoo Life Shopping

Grab a viral anti-aging snail serum for $13 (nearly 50% off) — plus other incredible price cuts we found today

Shop massive spring savings on beloved brands, which include Dyson, Apple, Ninja and more.

01 min read - USHuffPost

'Gross And Vulgar' Rob Schneider Comedy Set Reportedly Cut Short At GOP Event

The "SNL" alum lashed out following the report, telling TMZ it was "woke bulls**t."

2051 min read - LifestyleApartment Therapy

We Asked 3 Chefs to Name the Best Frozen Pizza, and They All Picked the Same One

Turns out, it’s a nostalgia thing.

383 min read - OpinionThe Telegraph

America’s ‘God of War’ is now many decades old. The US Army can’t replace it

Forget the tank, the fighter jet and even the drone. Artillery is the most important weapon on the modern battlefield, just as it was 100, 200 or even 300 years ago. It was not for nothing that Stalin dubbed artillery the ‘God of War’.

1815 min read - LifestyleTasting Table

A Bourbon Expert's Top Picks For Expensive-Tasting Bottles On A Budget

Bourbon can range from inexpensive to bank-breaking luxury, but just because you're looking to keep things cheap doesn't mean your bourbon can't taste fancy.

262 min read - NewsCNN

VideoBob Costas on what Johnnie Cochran told him privately after the OJ Simpson trial

CNN’s Bob Costas speaks with CNN’s Jake Tapper

642 - LifestyleBuzzFeed

15 Pictures That'll Have You Utterly Stumped For Several Minutes

Just some stuff that we witness on this little planet called Earth.

211 min read - USMen's Journal

Yellowstone Tourist Roars at Bison Before Getting Attacked

Being a respectful visitor who's mindful of flora and fauna is an essential part of visiting our national parks. But not everyone who gets out in nature knows how to leave everything as you found it. A video shared on Instagram by Tourons of Yellowstone showed what happened when a tourist ...

2942 min read - LifestyleSimply Recipes

The Only Way To Store Strawberries So They Last, According to Driscoll’s

The experts weigh on whether you should wash strawberries before storing and when it's time to toss them out.

43 min read